Hyperspectral Imaging (HSI) is around for quite some years and for the technical minded audience its potential is quite obvious and breathtaking. ´Every Pixel is a Spectrometer´ replaces expensive and slow lab equipment and allows instant in-line analysis of material flows instead of at-line or off-line analysis. The potential benefits have been well described for material sensing, food quality, sorting / recycling, medical diagnostics, ….. but more on an experimental level, as a proof of concept. Despite some organic growth of HSI suppliers, we can´t speak of mass deployment yet in any of these fields. Most articles still are on a conceptual basis.

Stuck in a niche

Most Suppliers of HSI Cameras are in the market for over ten years and still in single digit M€ revenue, some of them are not profitable. Out of ca. 15 manufacturers of Hyperspectral Cameras or systems in Europe:

- nine are older than ten years and still between 2 and 7M€ sales. They are not start-ups anymore but lack steep growth and critical mass to invest in sales globally.

- three are recent start-ups, some of them with breathtaking venture capital backup.

- only one company has sales of significantly above 20M€

The european machine vision market is known to be in consolidation mode. However, the initial hype about hyperspectral imaging turned into skepticism and investors are getting careful. Most sales that we are seeing today are single unit sales to scientific and research labs or military use. Their main motivation is the acquisition of knowledge, methods and insight. Users think pretty much like the suppliers of HSI equipment – deeply technical. The potential to scale is very limited. Those few machine builders (OEMs) using HSI in their machines are clearly positioned on the high-end and high-price segment, not (yet) addressing the majority market segments. Just a few industrial apps and serial deliveries are established in recycling of plastic waste or for sorting organic materials like vegetables, nuts, fruit or inspecting food quality, e.g. for meat and poultry.

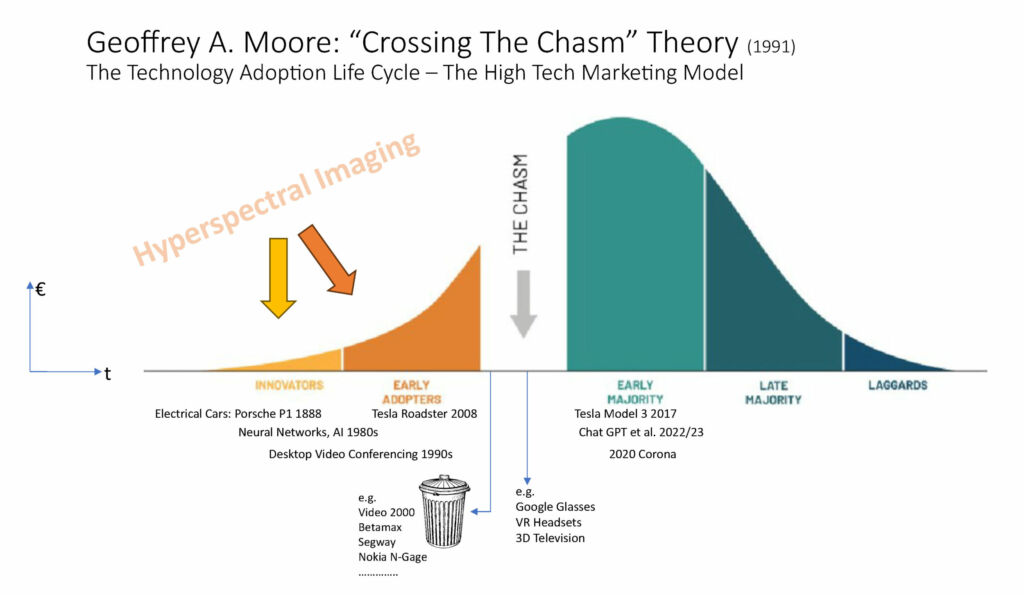

From Early Adopters to Early Majority

Geoffrey A. Moore has written a study in 1991 which exactly describes today´s dilemma of Hyperspectral technology. He kept wondering, why some new technologies stalled after an initial start, some came back later, but under completely different paradigms and some others died. What he called ´The Chasm´ marks the most significant transition into mass deployment and broad acceptance. The chasm in the technology adoption life cycle is a crucial phase between early adopters and mainstream users. During this phase, the technology’s limitations become clear, mainstream users need more proof, and the solution must mature. Effective marketing, distribution, and support become vital. Successfully crossing the chasm requires addressing commercial concerns, targeting specific segments, and achieving a tipping point for broader adoption. In some cases, the driving force behind the cross-over from early adopters to mass market was driven by external environmental conditions, presenting new use cases, in other cases it was a different level of usability, maturity and price-performance of the product itself. Sometimes both needed to happen. Drivers to cross the chasm are:

- Different Mindsets, from technology orientation to commercial pragmatism

- Overcoming technology limitations, user-friendliness, maturity

- Reference Points from Early Adopters

- Marketing and Messaging

- Distribution and Support

- Market Segmentation, Focus

For Hyperspectral Imaging one can clearly see that this technology is stuck on the left side of the chasm. Besides criteria on the technical level, the most important difference between left and right side of the chasm are the customer preferences and mindsets.

Customer Types and Preferences

If we look at today´s suppliers of HSI technology, they feel very much at home on the left side. Most companies are spin-offs of universities or research institutions. The founders are still in charge, former scientists. Therefore, they speak the same language, have a similar mindset like the customers on the left side. Customers are OK with prototypes that they can debug and tweak. On the right side however, where the money is, different factors are must-have’s: Robustness, repeatability, standardization, ease of use, instant service, no debugging and prototype-headaches.

Overcoming the Barriers to Scale with HSI

1. Connect SMEs to create sufficient critical mass by joint ownership or venture frame: Most suppliers in that field are too small to be taken seriously by large industrial operators. This Buy&Build strategy allows to expand the commercial footprint.

2. Focus only on vertical market segments with potential for scaling, e.g. industrial food production: Many small suppliers chase every order for the passion of new technical solutions, but also in despair to get any orders. A few segments however, have big scaling potential like the food industry – but they require more upfront investment.

3. Only solve problems that the customer is willing to pay for: ROI, Risk Reduction Stay away from the exotic onesie-twosie opportunities. Focus on ROI, risk reduction, measurable process efficiency improvements.

4. Change the Business Model from Component Sales to Solution Sales: Industrial end users don´t want to be bothered with technical details of spectral sensors. They want to see sorting purity, inspection safety / reliability or process improvement. This requires a completely different language and approach in sales and application-ready solutions instead of components.

5. Establish worldwide services: Real scaling starts when you get into one of the large producers with your machine vision solutions and be standardized on all their production lines. For them the solution becomes mission critical, demanding quick turn-around times and a local service operation everywhere.

6. Move price range from scientific single unit level to industrial serial product: HSI cameras in many cases are still hand-crafted and hand-calibrated single units. They are universal, flexible and well suited for Lab use. The cost of these units reflects the way they are produced. The biggest potential lies within the spectrum of Short-Wave-Infrared. It is expected, that there is a positive trend for decreasing InGaAs sensor prices at growing volumes.

7. Hide internal complexity by comprehensive application layers: This is probably one of the most difficult hurdles, as it comprises several levels of action. Interpreting hyperspectral data is complex and requires specialized expertise.

8. Combine functional components and integrate to application specific solutions: End-users need a working solution to their problem, not a puzzle of components. Machine builders have to adopt the role of full integration of the hyperspectral sensor suite into their machines.

9. Provide application-ready solution that integrates into existing workflows: To do this successfully, not only knowledge about vision technology is required, but domain knowledge from the vertical industry segment and their needs. This requires focus, specialization – and in order to scale: a global reach within this segment.

10. Use HSI as a differentiator only where needed: In some cases, alternative technologies or approaches (e.g. RGB cameras) might provide similar or sufficient information at a lower cost or with simpler implementation.

11. Heavy use of AI for Algorithms and for Process Control: AI plays a significant role in enhancing the capabilities and applications of hyperspectral imaging. AI can automate the analysis process, enabling real-time interpretation of hyperspectral data. This is essential for applications like production lines, where quick decisions are required. AI enables faster, more accurate analysis and interpretation.

Vision Solutions Group as a new platform

All the before said lead us to the conclusion that we need to create a different environment to enable growth and scale-up, combining the innovation power and expertise of existing players and adding the missing competencies by organic investment, mainly on the commercial side. With Swedish Alder we found an investor focusing on sustainable technologies, Insort GmbH is the first anchor investment and a market leader in sorting machines for nuts, dried fruit and potatoes, using HSI. This will become a group of highly specialized companies, optimizing the industrial production processes in the food industry. Its core technology shall be machine vision-based sensors which are seamlessly integrated into machines for different production processes. HSI will be a key differentiator to traditional technologies. More to follow soon.

cs-consult@t-online.de